Theme: Future Prospective and New Era Technologies in Biosimilars and Biologics

Biosimilars Congress 2022

Conference Series LLC Ltd, Scientific Event Organizer and the World Class Open Access Publisher invites all the participants from all over the world to attend “2nd World Biosimilars & Biologics Congress” (Biosimilars Congress 2022) slated on November 10-11, 2022, Vancouver, Canada which covers on all aspects of the pharmaceutical sciences, manufacturing, quality with strong emphasis on originality and scientific quality. This Biosimilars Congress 2022 setting a platform for all the budding Scientists and Researchers to present their real-time work and share their views and aspects related to the theme of the Conference. The Organizing committee is gearing up for an exciting and informative Conference program including plenary Lectures, Symposia, Workshops on a variety of topics, Poster presentations and various programs for participants from all over the World.

Biosimilars Congress 2022 conveys recent developments in Pharma drug marketing and production of Pharma drugs and contract manufacturing. A complete knowledge of a scientific discipline that described the effects of Biosimilars drug marketing and Biosimilars Pharma now explores the Scope of Biosimilars drug marketing in industry & provides detailed market, technology, and industry analyses to help readers quantify and qualify the market for prescription generic drugs. Important trends are identified and sales forecasts by product categories and major country markets these are based on industry sources and considered assessment of the regulatory environment, healthcare policies, demographics, and other factors that directly affect the generic drug market. The wider economic environment is also considered.

Track 1: Biosimilars:

A Biosimilars is a biologic restorative item profoundly like another previously affirmed natural prescription (the 'reference medication'). Biosimilars are endorsed by similar gauges of pharmaceutical quality, security and adequacy that apply to every single organic drug. Biosimilars are authoritatively affirmed forms of unique "pioneer" items and can be fabricated when the first item's patent expires. Reference to the trailblazer item is an indispensable part of the endorsement.

Track 2: Biologics:

A Biologic medication (biologics) is an item that is created from living beings or contains segments of living creatures. Biologic medications incorporate a wide assortment of items got from human, creature, or microorganisms by utilizing biotechnology. Kinds of biologic medications incorporate immunizations, blood, blood segments, cells, allergens, qualities, tissues, and recombinant proteins. Biologic items may contain proteins that control the activity of different proteins and cell forms, qualities that control creation of imperative proteins, altered human hormones, or cells that produce substances that smother or initiate segments of the invulnerable framework. Biologic medications are some of the time alluded to as biologic reaction modifiers since they change the way of activity of regular biologic intracellular and cell activities.

Track 3: Emerging Biosimilars in Therapeutics:

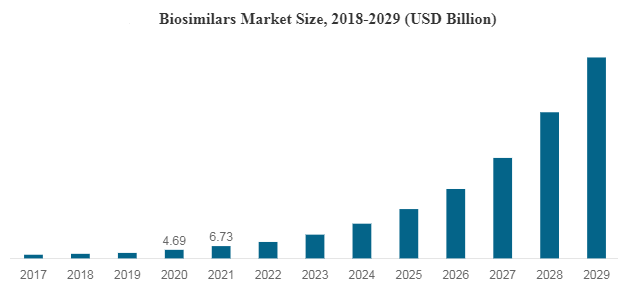

Biosimilars Market is experiencing a growth at an exponential rate. Presently around 700 biologics are making progress in the research pipelines of nearly 250 biopharma companies. Biosimilar insulins have already started revolutionizing the future drug development in the realm of diabetology. Biosimilars of Adalimumab, Etanercept, Rituximab, Peg-Filgrastim, and Trastuzumab are expected to hit the market soon. Biosimilar of Humatrope, biosimilar of Eprex, biosimilar of Neupogen, biosimilar of Remicade have already been enjoying a greater market share in Europe than the reference product itself. The proportion of different biosimilars that reached market are Low Molecular Weight Heparins 44%, Epoetins 19%, HGH 11%, G-CSFs 7%, Interferons 6%, Insulins 5%, Others 8%.

Track 4: Pharmacovigilance challenges in Biosimilars:

This session of the Biosimilars 2022 will investigate the future and FDA activities that have just been declared to incorporate upgraded following and follow-up of post promoting observation issues, arranged enhancements in AERS, and pilots of new post market drug-monitoring strategies and ADR related issues. Biosimilar rules for pharmacovigilance practice and pharmacoepidemiology are the focuses that will be laid emphasis in this session. U.S. normal yearly spending development from 2002 to 2007 was 16% for biologics, contrasted and 3.7% for drugs. In same extent pharmacovigilance for biosimilars has been nearly more than other pharmaceutical items.

Track 5: Biological Medicine:

Biological Medicine works with the biology of the body and its natural healing capabilities as well as the spiritual, emotional and physical aspects of disease. Disease means that the body’s regulation is not working properly and needs to be brought back into its natural dynamic state where the immune system is in full regulation. It therefore looks for root causes for the presenting symptoms of disease the underlying factors causing a person to present with a certain illness. These root causes may consist of several factors which have built up over time and can include; diet, food allergies, intestinal disturbances, family history, stress, environmental factors, heavy metals, dental problems, hyperacidity, trauma, exposure to bacteria or viruses or electromagnetic disturbances.

Track 6: Biopharmaceutical Informatics:

Biopharmaceutical informatics endeavors to use information technology, sequence-and structure-based bioinformatics analyses, molecular modelling and simulations, and statistical data analyse towards biologic drug development. Development of databases containing the experimental data on biophysical stability, safety along with molecular sequence

- Applications of computation in biologic drug development

- Physics-based molecular modelling

- Protein sequence-structural contexts and degradation reaction mechanisms

- De risk biopharmaceutical development

- Creation of databases and data mining

- Pre-clinical immunogenicity risk assessment of biotherapeutics

Track 7: Chemical and Analytical Strategies for Biosimilars:

While small changes in these parameters can impact the various chemical permutations for a given biotherapeutic, innovators can, under certain circumstances, change the host cell, fermentation process, purification process, and even manufacturing site, but the product can be validated without undertaking a complete new product development review

- Biochemical and Biosimilar Characterization

- Biosimilars multimodal techniques

- Biosimilars bioanalytical methods

- Bioassay for comparability and potency testing

- Biosimilars LC/MS analysis for discovery, preclinical and clinical programs

- Biosimilars GMP protein analysis

- Biosimilars electrophoresis

Track 8: Bioavailability and Bioequivalence:

Bioavailability is defined as amount of drug available to the target site after systemic circulation and Bioequivalence is the similarity of two drugs must release the active ingredient at the same amount, rate &quality. In this process the new drugs are tested for their stability studies. The new formulations undergo the analytical process to get approved by the FDA as a safe and effective dosage form. It is frequent to compare new drug with the standard product as a reference.

- In vivo & In vitro drug studies

- Accelerated stability studies

- Chromatography types and techniques

- HPLC to monitor β-lactam plasma

- Chemically, therapeutically and physically bioequivalent.

- Cationic prodrugs as dual gene reagents

Track 9: Biosimilars Development in Markets:

A Biosimilars bio therapeutic item is comparative (but not identical) as far as quality, wellbeing, and viability to an effectively authorized reference item. Not at all like nonspecific little particles, it’s hard to institutionalize such naturally complex items in light of convoluted assembling forms. The worldwide biosimilars advertise is developing quickly as licenses on blockbuster biologic medications terminate and other medicinal services parts centre on lessening of expenses. Biologics are among the most elevated cost medicines on the worldwide market today, which suggests the requirement for minimal effort choices. In developing markets, biosimilars officially offer more moderate costs, which are alluring, as well as crucial to economies where costly medications are not monetarily achievable.

- Biosimilars China and Asia Pacific

- Biosimilars India

- Biosimilars USA

- Biosimilars Europe

Track 10: Immunogenicity of Biosimilars:

Biologics and biosimilars are biotechnology-inferred proteins and can possibly be profoundly immunogenic. The results of a resistant response to a helpful protein go from transient responses to extreme hazardous conditions. Tolerant, infection and item related variables impact the advancement of immunogenicity, and appraisal of immunogenicity is constantly required for endorsement of a biosimilar. Appraisal of a biologic immunogenicity profile is directed in comparability clinical preliminaries to affirm that the immunogenicity profile of the biosimilar is like that of its reference biologic. An outline of clinical preliminaries evaluating the immunogenicity of infliximab biosimilars in patients with rheumatoid joint pain and ankylosing spondylitis and the outcomes from observational investigations in patients with gastroenterology maladies are displayed. Because of the little patient populaces examined in the comparability clinical preliminaries, the safe reaction may not be caught preceding permitting of the biosimilar. In this manner, continuous pharmacovigillance is required to guarantee the protected utilization of these novel treatments.

Track 11: Clinical Development of Biosimilars:

This track remembers Clinical preliminaries for significant illnesses Risk the board, and quality issues, Case ponders, and clinical models, Transgenic creatures, Targeted cell line improvement, Clinical biosimilar tracks.docx PK/PD thinks about, Toxicological examinations and Aspects of genotoxicity tests. Clinical preliminaries are planned in stages I-IV in order to get a reasonable image of the medication up-and-comer in regard to its pharmacokinetics and pharmacodynamics parameters. Biologics additionally speak to more than 40 percent of the medications in each of the preclinical, Phase I, Phase II, and Phase III preliminary stages.

Biosimilars became a new Classification of Food and Drug Administration (FDA) approved drugs according to the ‘’Biologics Price Competition and innovation Act’’ in 2010. They have the potential to allow for patient access to more cost-effective alternatives and may foster a competitive environment for the future development of biologic medicines. As the key biologics have begun to come off-patent in the U.S., there has been growing interest in biosimilars development that can compete with the potency and efficacy of existing biologics. Despite reflecting a slow start, the U.S. is expected to emerge as one of the fastest growing markets in the coming years.

As of April 2022, the number of approved biosimilars by the U.S. FDA in the U.S. is 35, out of which 21 have been made commercially available in the U.S. market. They offer comparable clinical utility over their reference products at a lower Cost, which is a key factor for their rising uptake in the U.S. market.

The global biologics market reached a value of nearly $253,414.8 million in 2020, having increased at a compound annual growth rate (CAGR) of 8.7% since 2015. The market is expected to grow from $253,414.8 million in 2020 to $420,551.5 million in 2025 at a rate of 10.7%. The market is then expected to grow at a CAGR of 9.6% from 2025 and reach $664,744.2 million in 2030.

The demand for biologics is anticipated to grow at a rapid pace due to the novel coronavirus outbreak. The pharmaceutical companies across the world are investing in research and development of vaccines against COVID-19, is positively affecting the biologics market. Many vaccines by pharmaceutical companies are under clinical trials. Consequently, if any of the vaccine under trial show further promising results against COVID-19, the biologics market will see significant growth

The biologics market is highly concentrated, with a small number of large players. The top ten competitors in the market made up to 67.4% of the total market in 2019. Companies in the market face completion for new product developments and technological advances. Major players in the market include Pfizer Inc., F. Hoffmann-La Roche AG, AbbVie Inc., Merck & Co., Inc., Johnson & Johnson, Bristol Myers Squibb Company, GlaxoSmithKline Plc, Amgen Inc., Sanofi S.A., and Eli Lilly and Company.

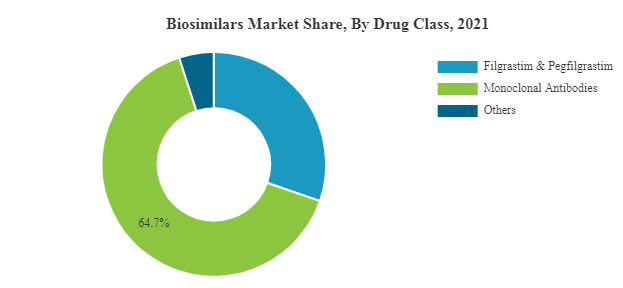

The top opportunities in the biologics market segmented by type will arise in the monoclonal antibodies segment, which will gain $75,160.9 million of global annual sales by 2025. The top opportunities in the monoclonal antibodies market segmented by type will arise in the anti-cancer mabs segment, which will gain $40,412.7 million of global annual sales by 2025. The top opportunities in the therapeutic proteins market segmented by type will arise in the metabolic disorders therapeutic proteins segment, which will gain $23,961.4 million of global annual sales by 2025.

The top opportunities in the vaccines market segmented by type will arise in the anti-infective vaccines segment, which will gain $13,307.5 million of global annual sales by 2025. The top opportunities in the biologics market segmented by route of administration will arise in the others segment, which will gain $164,888.7 million of global annual sales by 2025. The top opportunities in the biologics market segmented by drug classification will arise in the branded drugs segment, which will gain $130,303.2 million of global annual sales by 2025.

The top opportunities in the biologics market segmented by mode of purchase will arise in the prescription drugs segment, which will gain $129,786.1 million of global annual sales by 2025. The top opportunities in the biologics market segmented by distribution channel will arise in the hospital pharmacies segment, which will gain $79,943.8 million of global annual sales by 2025. The biologics market size will gain the most in the USA at $84,453.4 million.

Market-trend-based strategies for the biologics market include leveraging revised and less stringent regulations to develop new and improved biologics, shifting to biologic drug development to capitalize on the growing demand for these drugs, investing in R&D for the development of innovative biologics, and investing in research and development of biologics for the treatment of complex diseases. The top opportunities in the biologics market segmented by type will arise in the monoclonal antibodies segment, which will gain $75,160.9 million of global annual sales by 2025. The top opportunities in the monoclonal antibodies market segmented by type will arise in the anti-cancer mabs segment, which will gain $40,412.7 million of global annual sales by 2025. The top opportunities in the therapeutic proteins market segmented by type will arise in the metabolic disorders therapeutic proteins segment, which will gain $23,961.4 million of global annual sales by 2025.

Latest trends:

Patent Expiry of Blockbuster Biologics to increase the Uptake of these drugs.

According to McKinsey report, a number of blockbuster biologics with annual peak sales worth USD 60 billion will lose patent protection in the coming years. Since the top 25 biologics drive approximately 83% of the global sales, the patent expiry of many of this product has opened new possibilities for the market players. Taking complete advantage of the loss of patents for these biologics, the wave of biosimilars has entered the U.S market with the introduction of highly effective and potent drugs.

- For instance, in April 2022, Samsung Bioepis and Merck collaborated and launched the trastuzumad biosimilar Ontruzant in the U.S market.

Also the treatment with biologics therapy is much expensive, owing to higher Average Sale price (ASP) of biologics. Therefore, taking into consideration the growing prevalence of chronic diseases , such as cancer and rheumatoid arthritis, the adoption of these drugs is anticipated to be pronounced in the U.S. market.

- For instance, according to a 2021 article by Dotdash publishing, Amgen drug Neulasta to treat neutropenia costs more than the USD 10,000 per ml , whereas its biosimilar,Ziextenzo,costs around USD 6,500 per ml,which saves around 37% overall cost

Driving Factors:

Growing Strategic Partnership and Commercial Agreements in the U.S. to Augment the U.S. Biosimilars Market Growth

Biosimilars clinical and economic benefits are showing great promise in the U.S. healthcare industry. According to the RAND Corporation, the robust uptake of these drugs across the globe can reduce direct spending on biologics by USD 54 billion by the end of 2026.To gain a competitive advantage in such a growing industry in the U.S., various drug makers are entering into strategic partnerships, collaborations, or commercialization. The collaborations aim to make high quality, affordable drugs accessible to patients in various therapeutic areas.

For instance, in February 2022, Biocon Biologics entered into a definitive agreement to acquire the biosimilars business of viatris, a global franchise focused on oncology, immunology, and endocrinology, with an aim to strengthen its position through its portfolio and future pipeline biosimilar drugs.

The market in the U.S. is considered to be fairly flat and is emerging at a slower pace with a regulatory framework being set in place. The partnerships are thus enabling the competing companies to strengthen their ability to deliver the next generation drugs and improve the accessibility of these drugs and improve the accessibility of these drugs in the U.S. Considering the ongoing litigations, the innovators are entering into agreements with biologic manufacturers. This is a factor attributed to driving the market during the forecast period.

In April 2018, AbbVie Inc., entered into an agreement with Samsung and Amgen for Humira biosimilars in which AbbVie will begin granting country-by-country licenses to both the companies in Europe, with the U.S. expecting the arrival by mid-2023

Restraining Factors:

Challenges with the drug development, Clinical Processing, and Cost of Development to Hinder the Market Growth

Usually, generic drugs are 40% to 50% less expensive than branded Pharmaceuticals and biologics. In contrast, biosimilars are just 15% to 20% cheaper than biologics. This is attributed to high development costs, clinical testing, and high resource investment. Additionally, generic drugs require fewer modifications, making the manufacturing process easy and less costly. The development costs for generic drugs range from around USD 2-3 million, where as the development cost of biosimilars is higher.

For instance, according to a 2021 article published by springer link, the cost of developing and gaining approval for a biosimilar in the U.S. ranges between USD 100.0 million to USD 200.0 million, which is significantly higher than the cost of developing generic drugs, which ranges between USD 1.0 million to USD 5.0 million.

Along with this, biosimilar development takes around five to nine years compared to the development of generic drugs, which takes approximately two years. So this time duration is considered very long from the investors and manufacturers point of view. This restraining factor is anticipated to slow down the market growth during the forecast period.

Hence, the factors mentioned above, coupled with limited information on efficiency due to which the healthcare providers are reluctant to switch on biosimilars are limiting the growth of these drugs in the U.S market.

COVID-19 Impact:

The outbreak of covid-19 had minimal impact on the sales generated by these drugs in U.S the prevailing trend is attributable to improved supply chain management and enhanced R&D Capabilities.

For instance, in 2021, the global biosimilar business of Pfizer reported revenue of USD 2.34 billion. The U.S contributed to almost 66.6% of the revenue by generating USD. 1.56 billion.

However, due to outbreak of Covid19, the financial year 2021 witnessed only 4 FDA approval and two biosimilar were launched in the U.S., as compared to 10 approvals and 6 launches in 2019. The trend was mainly attributed to the cof regulatory approvals during pandemic and increased focus on approvals and the development of vaccines and treatment related COVID-19 therapy.

Despite the lower approvals in 2021, the FDA reported numerous biosimilars related submissions in the pipeline at FDA for the fiscal year 2021. This is projected to compensate for the slower growth rate of the market in the U.S. in 2021 and the limit impact of COVID-19 on the overall revenue generated from during the period.

Key Industry Players:

Higher Investments in R&D by Amgen Inc. Enabled its Dominance

The market is consolidated, with few players accounting for maximum share of the market in the terms of revenue. The key companies operating in the market are Pfizer, Inc. Novartis (Sandoz), Amgen, Inc., and Samsung Bioepis.

Amgen Inc. accounted for the largest share in the market. It established a market for its novel drug called ‘Mvasi ,’ and its improved prescription rate in the country is the key factor for the dominance of the company in 2021. Moreover, the company has a strong focus on R&D to maintain its brand position in the market. Other players included in the U.S. market are are Pfizer, Inc. Novartis (Sandoz) and more.

List of Key Companies Profiled:

Pfizer Inc. (US)

Amgen Inc. (US)

Samsung Bioepis (South korea)

Novartis Inc. (Switzerland)

Celltrion Inc. (South korea)

Viatris Inc. (US)

Coherus Biosciences (U.S)

For Visa Application process, please follow general steps as a guide. The application process is different for each country. It is your due diligence to check with the Canada Embassy within your country for the detailed procedure on visa application.

[Step A:]

In order for Biosimilars and Biologics 2022 organizers to provide an Invitation Letter for your visit, you must first register to attend Biosimilars and Biologics 2022. Once your registration is completed, you will receive a confirmation letter and an official receipt with your registration number/ID.

Click here to know more about the registration packages and fees

[Step B:]

You will need an invitation letter to apply for visa. To request for one, applicant is required to provide his/her registration number/ID.

Processing and mailing time vary for each country so please allow 01-07 days for the visa invitation letter to reach your mailbox.

Please note that application for invitation letter is open to Conference Speakers, delegates, Students (Only registration & Package A/B) and Exhibitors.

The organizers of Biosimilars and Biologics 2022 reserve the rights to refuse any application if it is deemed suspicious of any illegal activities.

[Step C:]

You will also be required to fill up the visa application form and all other forms necessary as a part of the visa application process to enter Canada. Click here to download the forms.

Other documents such as birth certificate, a copy of identification card and certificate of employment may be required from you. For the full list of documents required, please visit the website of Global Affairs Canada

For visa processing time, fees and other related matters, click here.

To request for further assistance regarding the visa application or requirements, kindly email to, with your registration confirmation number/ID.

Note: Your visa application is dependent on the final decision of the Canada Embassy. Biosimilars and Biologics 2022 organizers cannot guarantee an approval/acceptance at any stage of the application process.

*** Important links:

- Requirements to enter Canada

- Find out if you need a eTA or visa

- Travel documents and identification requirements

- Visa Fees information

Conference Highlights

- Biosimilars

- Biologics

- Emerging Biosimilars in Therapeutics

- Pharmacovigilance challenges in Biosimilars

- Biological Medicine

- Biopharmaceutical Informatics

- Chemical and Analytical Strategies for Biosimilars

- Bioavailability and Bioequivalence

- Biosimilars Development in Markets

- Immunogenicity of Biosimilars

- Clinical Development of Biosimilars

- Factors potentially affecting immunogenicity of a biologic drug

- The role of healthcare professionals in improving pharmacovigilance for biosimilars

- Potential benefits of biosimilars

- Biosimilars versus generic drugs

To share your views and research, please click here to register for the Conference.

To Collaborate Scientific Professionals around the World

| Conference Date | November 10-11, 2022 | ||

| Sponsors & Exhibitors |

|

||

| Speaker Opportunity Closed | |||

| Poster Opportunity Closed | Click Here to View | ||

Useful Links

Special Issues

All accepted abstracts will be published in respective Our International Journals.

Abstracts will be provided with Digital Object Identifier by